Choosing A Finance Plan

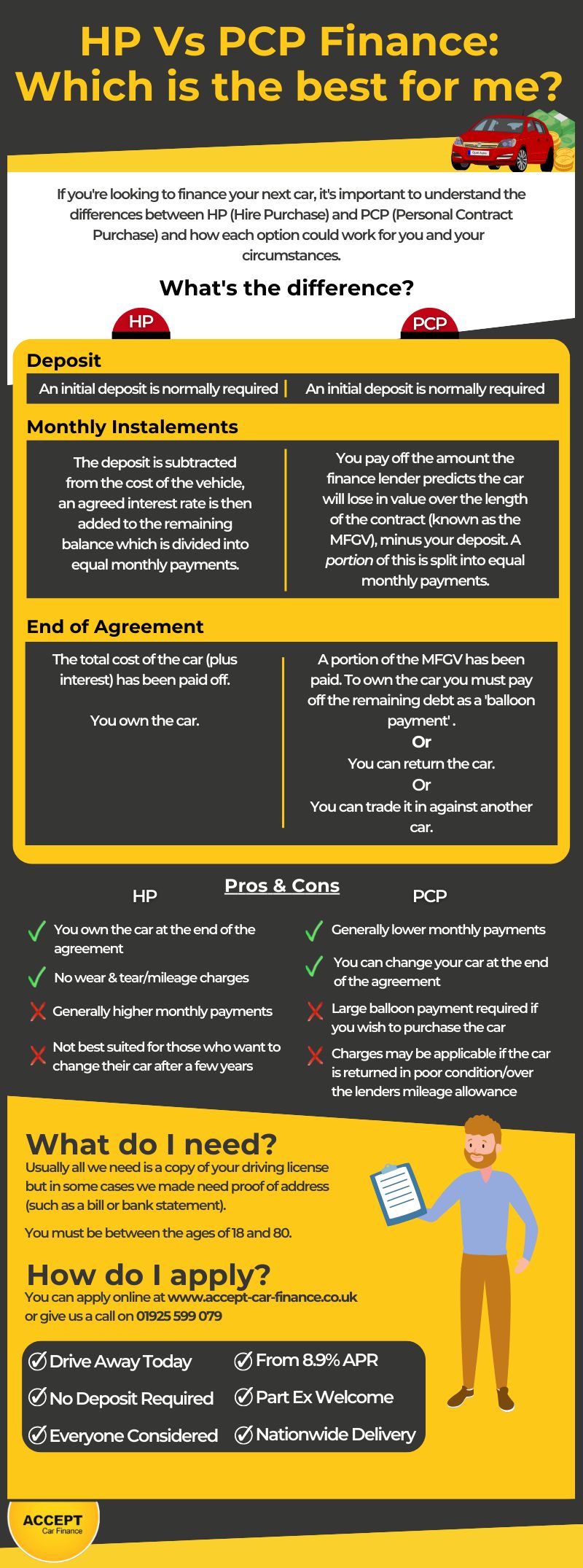

If you’re looking to buy a car, then the cost is likely one of your main concerns when it comes to many options. The problem is, if you’re to get a reliable car that’s in good condition, it’s going to be somewhat expensive, and not everyone can afford that. Not to worry, as there is a solution to your problem. There are a few forms of payment you can go with when purchasing from a dealership, PCP (Personal Contract Purchase) and HP (Hire Purchase) financing are good choices, but differ when it comes to their uses.

If you’re looking for the cheapest options available, then finance likely isn’t the best option for you. Still, it does offer you the ability to pay in smaller instalments over an agreed period. So while you would be spending less now, you may find the total amount you’ve paid is more than the total sum of the car’s value.

When it comes to choosing between HP and PCP car finance, there are a few things you should be aware of – because you’re paying for two different things. The most notable is, with HP finance, once you’re finished with your payments, the car belongs to you. It’s yours to do what you want with, though you may have paid more than you would have if you went with PCP finance. With PCP finance, the car won’t be yours until you’ve paid extra at the end of your agreement, so it’s a little less beneficial for those who are aiming to keep the car.

Infographic About PCP Car Finance