The best funds to invest in

Money doesn’t grow on trees, unfortunately, which is why many people think outside the box and look for simple yet effective ways to manage their finances and boost their income.

While popular methods like regular savings accounts and cash ISAs have their benefits, looking to get returns from an investment fund could open up many new opportunities and prove to be an extremely profitable move – but what does this process entail and what are the best funds to invest in? Let’s delve a little deeper.

What are funds?

Essentially, a fund pools together money from many individuals and typically smaller investors and then the fund manager uses that money to invest in a wide range of assets such as cash, bonds, equities and property. Each fund tends to have a specific investment objective which influences how and where the money is spent.

So what are the benefits? A pooled investment is great for many reasons. Not only can you take advantage of the fund manager’s specialist knowledge but by investing in a fund with many other people you can also gain access to economies of scale when trades are made – such opportunities that might not be open to individuals investing directly.

What’s more, many funds allow you to start investing with small sums of money meaning you can build up a diverse portfolio relatively cheaply and quickly – often for less than you could buying individual stocks and shares. As all funds are managed professionally, you won’t have to worry about keeping track of dozens of holdings which should offer peace of mind in whatever fund you opt for.

Finally, as funds typically invest in multiple assets they can spread the risk of your investment and make you less reliant on the success or failure of a typical company. Of course, the value of investments can go up as well as down but by investing in hundreds of companies instead of one or two you’re not putting all your eggs in one basket.

Numerous companies offer investment buying and investment management services like this. Let’s take a look at some of the best options available to you.

Nutmeg

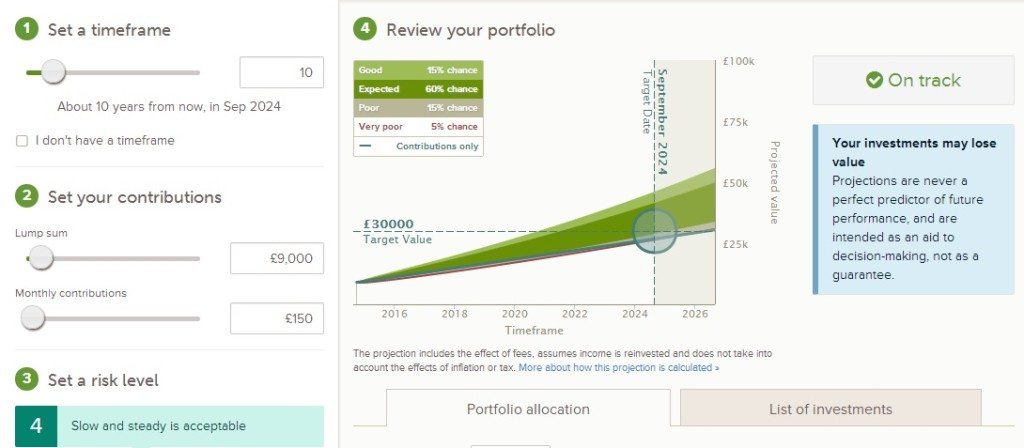

Nutmeg is a multi-award winning online investment manager based in the UK that is injecting spice into the retail market and makes managing your investment portfolio incredibly easy. Founded in 2011, Nutmeg offers excellent choice and flexibility with your investments. You can set up a portfolio – that Nutmeg will fully manage for you – in less than 10 minutes.

So how does Nutmeg operate? Well, Nutmeg works out what type of investor you are based on your tolerance to risk and your answers to a few simple profiling questions. They then construct a portfolio that’s tailored to you by buying the appropriate funds. Although much of the process is automated behind the scenes, there is a team of human investment managers who are constantly monitoring the markets and looking for opportunities for better returns on your investments. This means that you receive a well-balanced service that benefits from the low-cost and high-efficiency of an automated investment allocation and the insight, knowledge and know-how of professional wealth managers.

Nutmeg’s interface is simple and intuitive to use, making investing with discretionary managers easier, more transparent and cheaper. You can put your investments in a stocks and shares ISA wrapper with Nutmeg and they are on the verge of launching a pension service.

The price mode is also incredibly straightforward. In short, you get charged a fee between 1.0 per cent and 0.3 per cent based on how much money you invest. So, if you invest £1000 you pay an annual 1 per cent fee. If you invest £50,000 the rate goes down to 0.75 per cent and anyone investing more than £500,000 is charged 0.3 per cent.

Here are some of Nutmeg’s customer reviews:

“Nutmeg have taken away the burden of managing my money. I feel safe. With Nutmeg, I have an expert investment team.” — Fergus, chartered accountant

“They give me absolute trust that they’re on top of my finances — as much as I would be if I was managing it.” — Helen, managing director

“Nutmeg really called out to me. I felt it could offer a better return on my investment, in a way that suited me.” — Darren, business consultant

“I’d given up ever findingprofessional support I could have faith in again until I came across Nutmeg.” — Nilmini, senior manager

Hargreaves Lansdown:

Hargreaves Lansdown is a successful, award-winning financial service company based in Bristol. Regulated by the Financial Conduct Authority, it’s currently the UK’s largest fund supermarket and specialises in fund, pension, wealth and annuity management, stock brokerage and financial advice.

Its flagship Wealth 150 funds list has 91 funds and is attracting many investors despite competitors also attempting to dish out inviting fund lists of their own. Signing up for a Hargreaves Lansdown account is also very easy and takes you through the process of registering for various types of accounts, including a fund and share account. The website is user friendly, fully-functional and does not disappoint as some of the other execution only platforms do.

Having an online account also gives you access to many innovative website features. A section of the site, for instance, is dedicate to helpful investment ideas enabling you to make well-informed financial decision. Unlike Nutmeg, however, you’ll need to keep track of how your investments are doing in line with the financial markets and decide on any adjustments you feel necessary.

The Wealth 150+ list and the Master Portfolios feature heavily throughout the site. The Master Portfolios are five ready-made investment portfolios for long-term investors. With funds from all the main industry sectors managed by specialists, they can suit any level or risk and investor might opt for. Five categories of portfolio style are included. The result of any query is a list of three suggestions based on investment size, risk adversity and preferred return timeframes and levels.

Bestinvest:

Bestinvest is a private client investment advisor looking after over £4 billion of assets for more than 50,000 clients. The company is a fast-growing private client advisory firms and offers a range of investment services with transparent, competitive prices.

The company was founded in 1986 by John Spiers. Back then, Bestinvest began as a specialist firm focused on researching and broking tax-efficient investments including Business Expansion Schemes, from which the firm took its original name (BESt Investment). It has enjoyed huge growth and success in recent years and is a very popular choice for people who want quick access to a range of funds at reasonable cost. They also offer a real wealth of information on investment principles and products to help you make the right decisions.

Here’s what a selection of their customers have said about the company:

- “Generally clean, helpful website with lots of information, including useful assessments of fund management skills, investment trust ratings and discounts, unit trust fund ratings, Spot the Dog, news updates. Appear to be truly independent.”

- “Regular newsletters, informative webpage, personal advisor, discounted fund purchases.”

- “I’ve have been with Bestinvest for a number of years and have been generally very happy. They give really good discounts when buying an ISA on the web, and last time I spoke to them about a fund their staff came across as really knowledgeable.”

- “To me, picking the right fund is top importance, this is also where Bestinvest score as their top funds and research data is spot on, and it’s independent (not semi-independent as I’ve found elsewhere!). No rebate of annual charges, but that’s fine with me as research into picking the right fund and their web online service more than makes up for it. All in all, works for me!”

This is a guest post with some useful information, however before you invest any money please do look into your options further and seek independent financial advice