#AD

It may not surprise you to know that lots of adults in the UK have credit card. In fact, in February this year, it was reported that 66 million credit cards were in circulation.

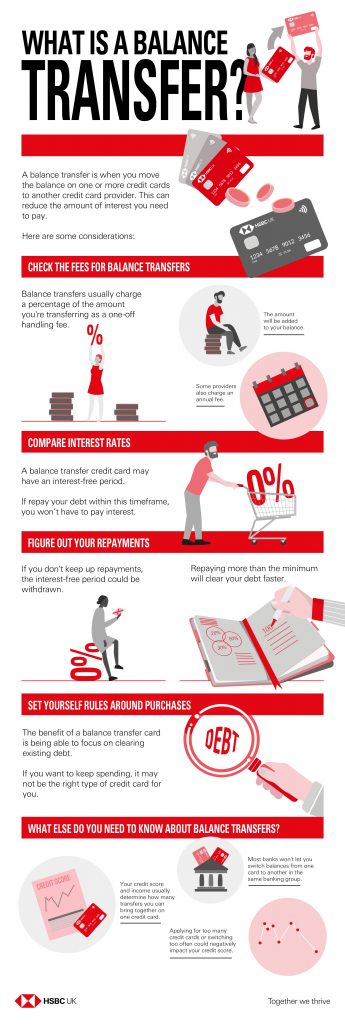

If you are one of those people that have a credit card, have you ever considered a credit card balance transfer or do you even know what a credit card transfer is? Let me talk you through the basics of credit card balance transfer and how they work for you.

What is a balance transfer?

Well, what is a balance transfer? A credit card balance transfer simply means, moving money from one credit card to another. Now depending on the company your credit card is with there are a few terms to that, which I will explain shortly.

Regardless of who your card is with though, the whole transfer process is simple and now very quick.

How much can I move?

This is dependant on the card you are moving to and the limit. Usually, you are allowed to move up to 95% of the credit limit on the card you are moving to.

You will need to check the deal with each individual card provider.

Is there a charge?

Again, this will need to be something you will need to check with your card provider. Most providers do charge a percentage of the balance to process the transfer, such as 2.75%.

It feels like a considerable chunk, however, if you are moving to save money on the interest it could actually save you money. For example, if you are moving £1000 to a card that charges a 2.75% fee you will pay £27.50 to do so. This however may be less than the interest you may have previously been paying. You will need to weigh up the pros for your transfer based on your personal circumstances.

Do I have to move?

No one has to move credit card providers, however, many do move to save money in the long term. For us, we move when our fixed term interest-free period ends. Simply because it is cheaper to do that than pay the interest on the card.

You need to work out what is best for you. If you clear your balance every month, moving card providers probably isn’t going to change much for you. However, if you are on a debt-free journey, saving the interest by moving at the end of the term probably will help you.

The key point to remember!

If you do decide to do a credit card balance transfer, don’t forget to close your previous card! So many people get caught out by leaving it open and then leaving the temptation there to spend more money. Once you’ve checked the balance is clear, have the card closed and close that account down. If you are struggling with your debts, this post is a great place to get started on tackling your finances.

This infographic produced by HSBC Balance Transfer Credit Cards, is a great visual way to understand balance transfers.